What happens When Digital Transformation Finally Works

PDF version

Executive summary

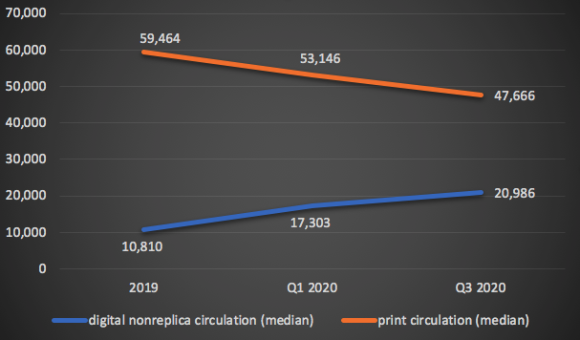

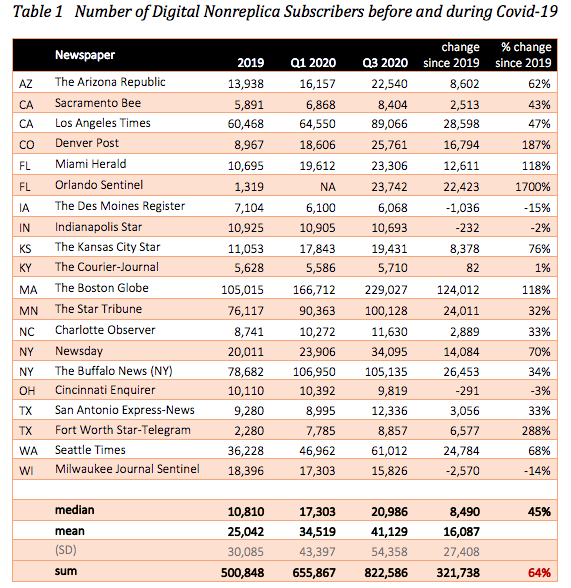

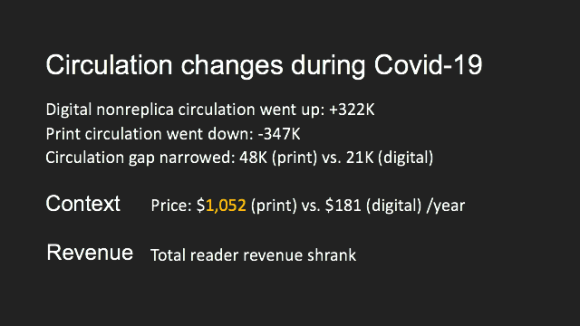

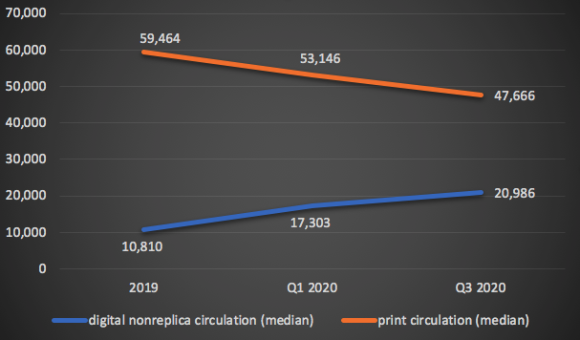

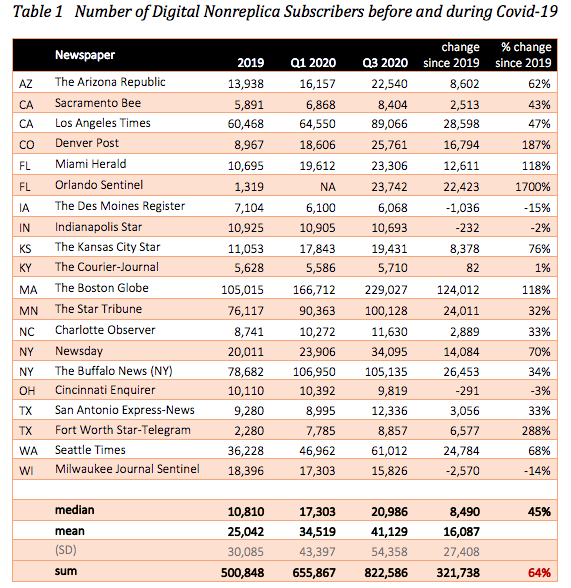

A persistent problem facing U.S. newspapers is users’ lukewarm response to their digital offerings. Has Covid-19 changed this? To answer this question, we analyzed 20 metro newspapers’ circulation data. Most reported substantial growth in digital subscriptions during the pandemic. Overall, the number of digital subscriptions went up by 64% between 2019 and Q3 2020.

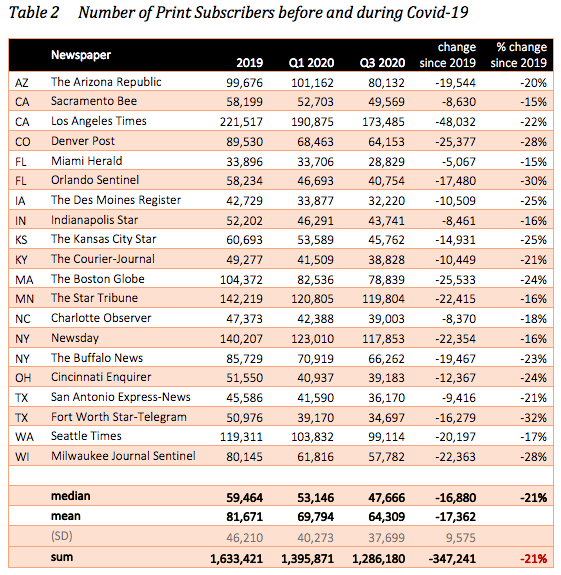

We also analyzed pricing data. The price of print subscriptions has reached an all-time high—seven-day home delivery now costs nearly $1,000/year. It takes nearly six new digital subscriptions to make up for the revenue loss of one print subscriber.

Despite the growth of digital subscriptions, the quickened declines in print circulation (21%) and the gigantic print-digital price gap suggest a decrease in overall subscription revenue.

Has Covid-19 narrowed the print-digital gap?

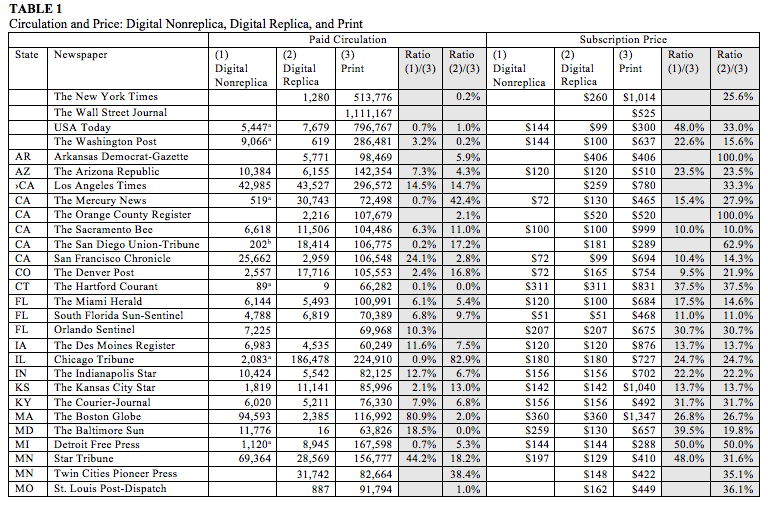

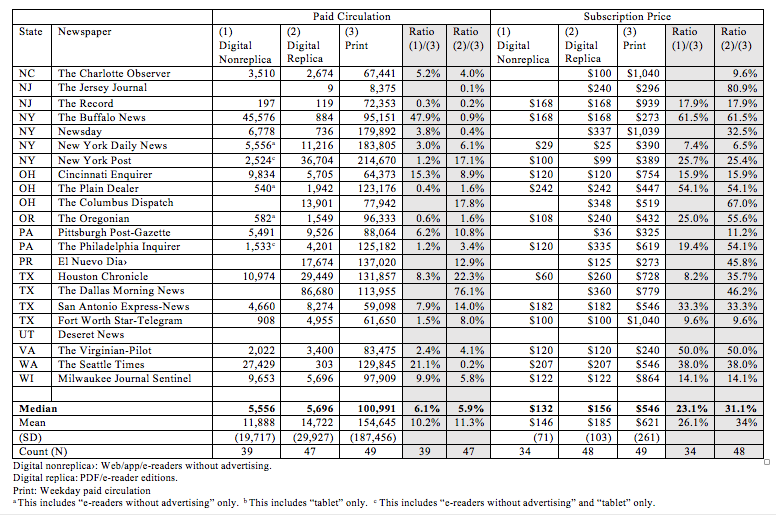

Despite continuous declines in print circulation, most U.S. newspapers’ legacy product still outperforms the same newspaper’s digital offerings in terms of engagement, circulation, pricing, advertising, and subscription revenue—all by a wide margin. Our previous study based on 50 newspapers’ 2017 data estimated that digital accounted for about 3% of total subscription revenue.

But Covid-19 has created an unprecedented scenario where the need for instant, local news updates and the fear of physically contacting anything tangible may change consumer behavior. Economic stress could also drive print subscribers to cheaper alternatives—such as the same newspaper’s digital product.

In this report we examine the impact of Covid-19 on digital and print circulation. The extent to which the pandemic has narrowed the print-digital gap carries managerial implications.

Sample of 20 Metro Dailies

Drawing from a list of 50 publications in Pew’s 2016 State of the News Media Report, this analysis focused on 20 U.S. metro daily newspapers that filed digital nonreplica circulation data (e.g., web, mobile/smartphone, tablet, eReaders without advertising) and with no missing data preventing comparisons between 2019 and 2020.

Each newspaper’s weekday paid digital nonreplica and print circulation data were retrieved from the reports filed for the Alliance for Audited Media in 2019, Q1 2020, and Q3 2020. Digital pricing data were collected from these newspapers’ websites.

How has digital circulation changed during Covid-19?

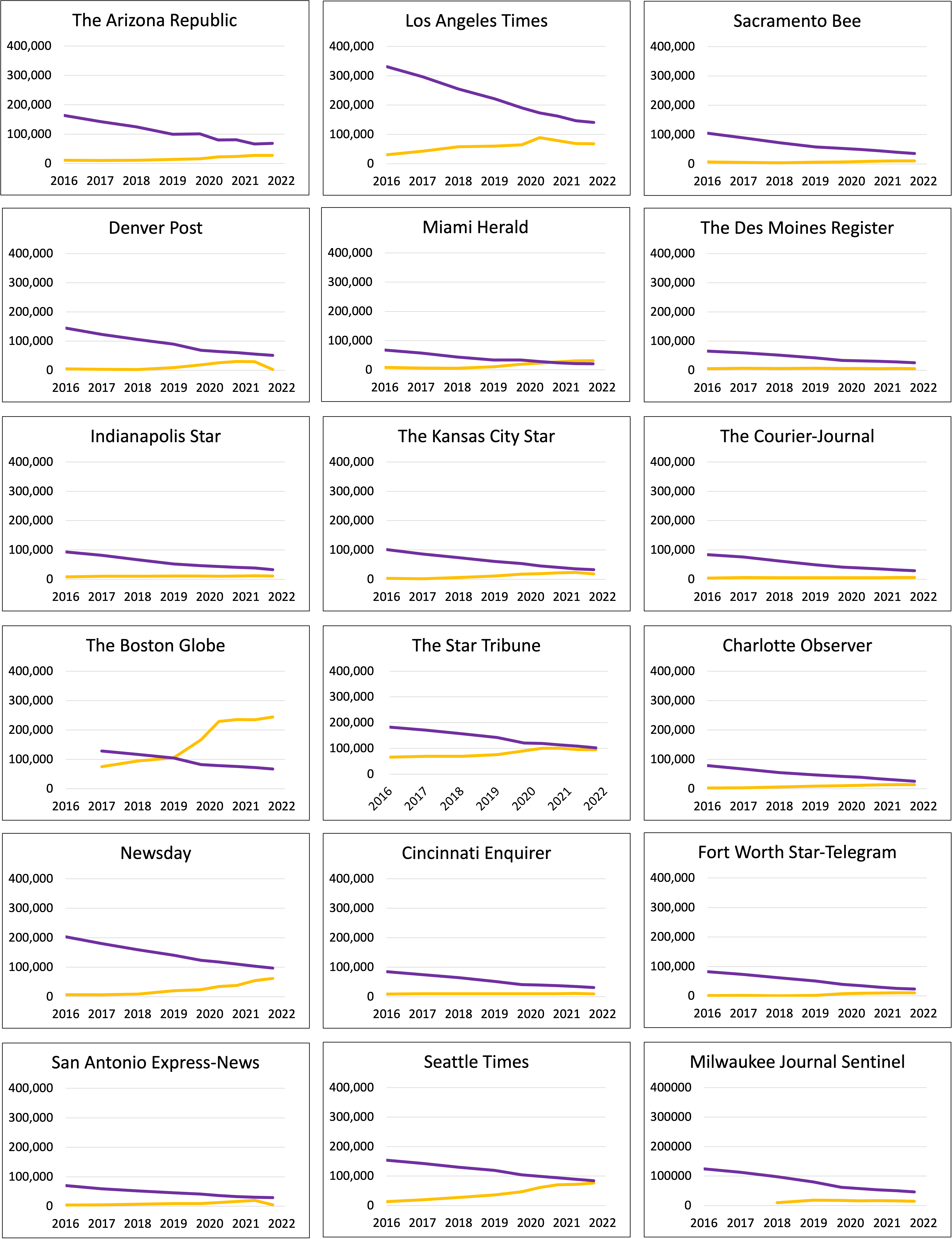

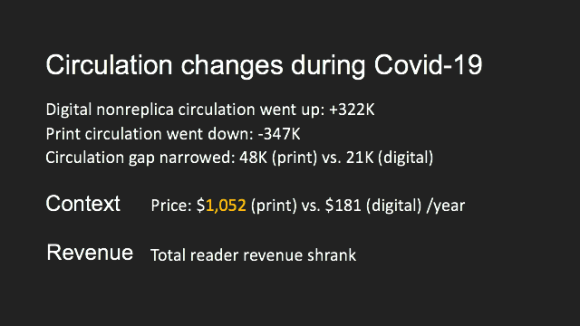

Among the 20 newspapers under study, the majority (n=16) have seen a growth in digital circulation. Overall, these newspapers have gained 321,738 digital (nonreplica) subscribers since 2019—a 64% increase.

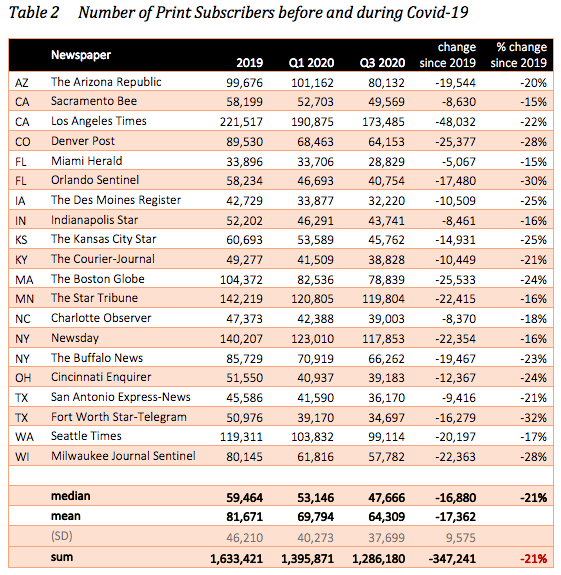

How has print circulation changed during Covid-19?

All the 20 newspapers reported a decrease in print circulation. Overall, these newspapers have lost 347,241 print subscribers since 2019—a 21% decrease.

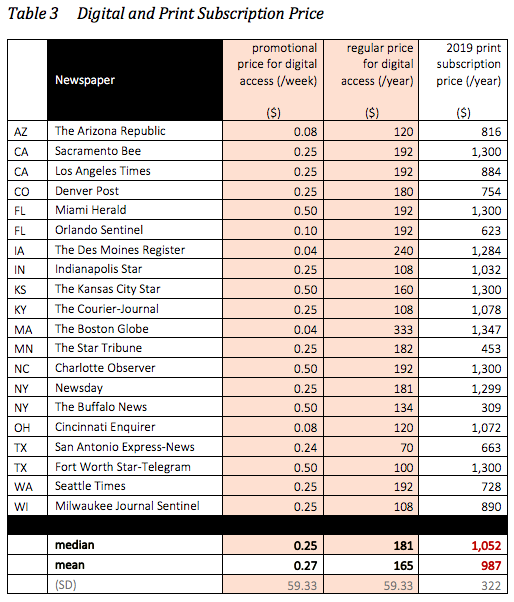

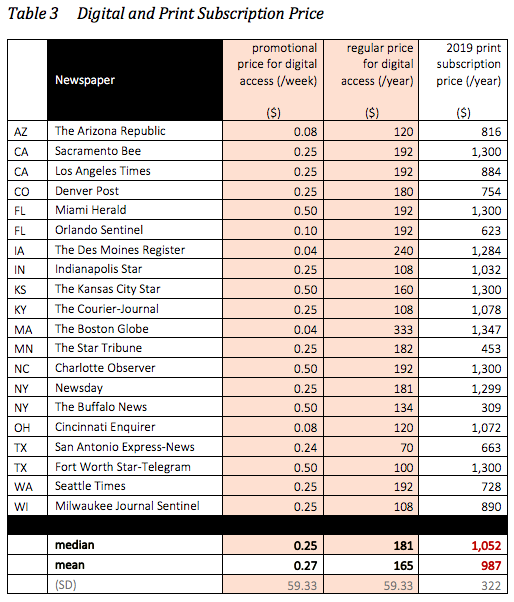

How much does a digital/print subscription cost?

The median price for all digital access is $181 a year, with introductory digital offers as low as $.25 a week, while 7-day print subscription prices reached a whopping $1,052 (median) or $987 (mean) a year. The shocking price gap suggests that it takes nearly six new digital subscribers to make up for the loss of one print subscriber.

Digital Transformation and Revenue implications

During the pandemic, the circulation gap between print and digital has narrowed significantly, yet the print edition remains the core product, with a lot more subscribers paying so much more than digital subscribers.

Because of the gigantic price gap between print and digital editions, the impact of Covid-19 on total subscription revenue is negative.

This pandemic has made it clear that when digital transformation finally happens, the net result is unfortunately “exchanging analog dollars for digital dimes.” The industry must reassess its pricing, product, and revenue strategy. Otherwise, as John Garrett, publisher of Community Impact Newspaper, suggests, “This digital reader revenue push will leave news organizations with the worst left-at-the-altar story of all time.”

Related studies (available upon request)

Chyi, H. I. & Ng, Y. M. M. (2020). Still unwilling to pay: An empirical analysis of 50 U.S. newspapers’ digital subscription results. Digital Journalism, 8(4), 526-547.

Chyi, H. I. & Tenenboim, O. (2019). Charging more and wondering why readership declined? A longitudinal study of U.S. newspapers’ price hikes, 2008-2016. Journalism Studies, 20 (14), 2113-2129.

Chyi, H. I. & Tenenboim, O. (2017). Reality check: Multiplatform newspaper readership in the U.S., 2007-2015. Journalism Practice, 11(7), 798-819. Ellen A. Wartella Distinguished Research Award.

Chyi, H. I. (2017). Reality and irrationality: U.S. metropolitan newspapers between print and digital (pp. 12-22), in Print-online performance gap: A U.S.-only study raises debate. World Printers Forum Report, published by WAN-IFRA (World Association of News Publishers), Frankfurt, Germany.

PDF version

PDF version